The TRNSACT team is proud to support Equipment Finance Connect 2024, a premier event connecting...

4 Benefits of Pulling Commercial Credit Reports with Paynet and TRNSACT

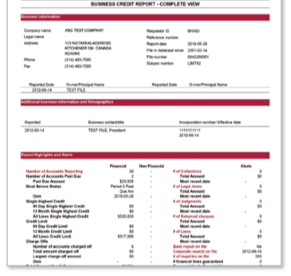

For commercial equipment and truck dealerships, having the right tools is essential for delivering fast, reliable financing solutions in a B2B environment. With TRNSACT's seamless integration with Paynet, running business credit reports is now easier than ever—just one click and you’re set. This feature is helpful for speeding up your sales and financing process while addressing key challenges around data compliance requirements for commercial dealers.

Enhance Efficiency in Daily Operations

IImagine a customer walking into your dealership eager to finance their next big purchase, but the clock is ticking, and you need to act fast. With TRNSACT’s Paynet integration, you can quickly pull commercial and consumer credit reports directly within our platform. No more juggling multiple portals or wasting time entering customer information repeatedly. This streamlined process saves valuable time, enabling you to provide quicker financing decisions that keep your business customers happy and coming back for more.

Cost Savings That Impact Your Bottom Line

In addition to improving efficiency, leveraging TRNSACT's partnership with Paynet means accessing credit reports at a lower cost. Instead of absorbing the expenses of running reports independently, you can take advantage of the discounted bulk pricing TRNSACT enjoys. This cost-effectiveness allows you to offer competitive financing options to your customers while improving your dealership’s profitability and reducing risk. You could pass the savings on to your customer or reinvest the money saved into your dealership's inventory, advertising budget, or sales bonuses.

Strengthened Compliance and Data Security

As a dealership, staying compliant with financial data security regulations like the 1071 rule is critical. With TRNSACT’s Paynet integration, you can easily manage who has access to sensitive commercial credit reports, ensuring that only authorized personnel can view this information. This heightened level of data security not only protects your dealership but also builds trust with your customers, who can feel confident that their financial information is handled with care. By centralizing access and saving reports in TRNSACT Deal Folders, you also align your operations with compliance requirements, making audits smoother and less stressful.

Informed Risk Management Decisions

With the ability to quickly access financial insights, your team can make more informed risk management decisions. Whether assessing the financial viability of a new client or understanding the long-term potential of their business, having access to accurate and timely credit reports is invaluable. The enhanced reporting capabilities help you determine the risk of extending credit, enabling your dealership to make sound financing decisions that benefit both your customers and your bottom line.

Take the Next Step with TRNSACT

Ready to elevate your dealership’s credit reporting process? By integrating TRNSACT’s Paynet credit reporting module into your existing software, you’re not just adopting a tool—you’re embracing a solution that enhances your efficiency, reduces costs, and strengthens compliance.

Learn More About Paynet Integration

If you own or manage a commercial equipment or truck dealership, you don’t need the resources of a big bank to offer competitive financing solutions. With TRNSACT, you gain the tools you need to succeed and serve your customers better. Let’s transform the way you team pulls commercial credit reports together! Schedule a demo with an equipment industry expert and learn how easy it is to enhance your F&I department with TRNSACT equipment dealer software.

Book an equipment finance software demo with the TRNSACT team.

“The TRNSACT finance portal is a phenomenal way to keep everyone in the loop on current stages and updates for each applicant. This new process is forecasted to produce fast exponential results within a 90-day span,”

Deana Chung, Hyundai Finance Leader and TRNSACT Customer